Gaming-ETFs

Kostengünstig und breit gestreut in Gaming-ETFs investieren. Jetzt mit dem Scalable Broker Gaming-ETFs gebührenfrei besparen.

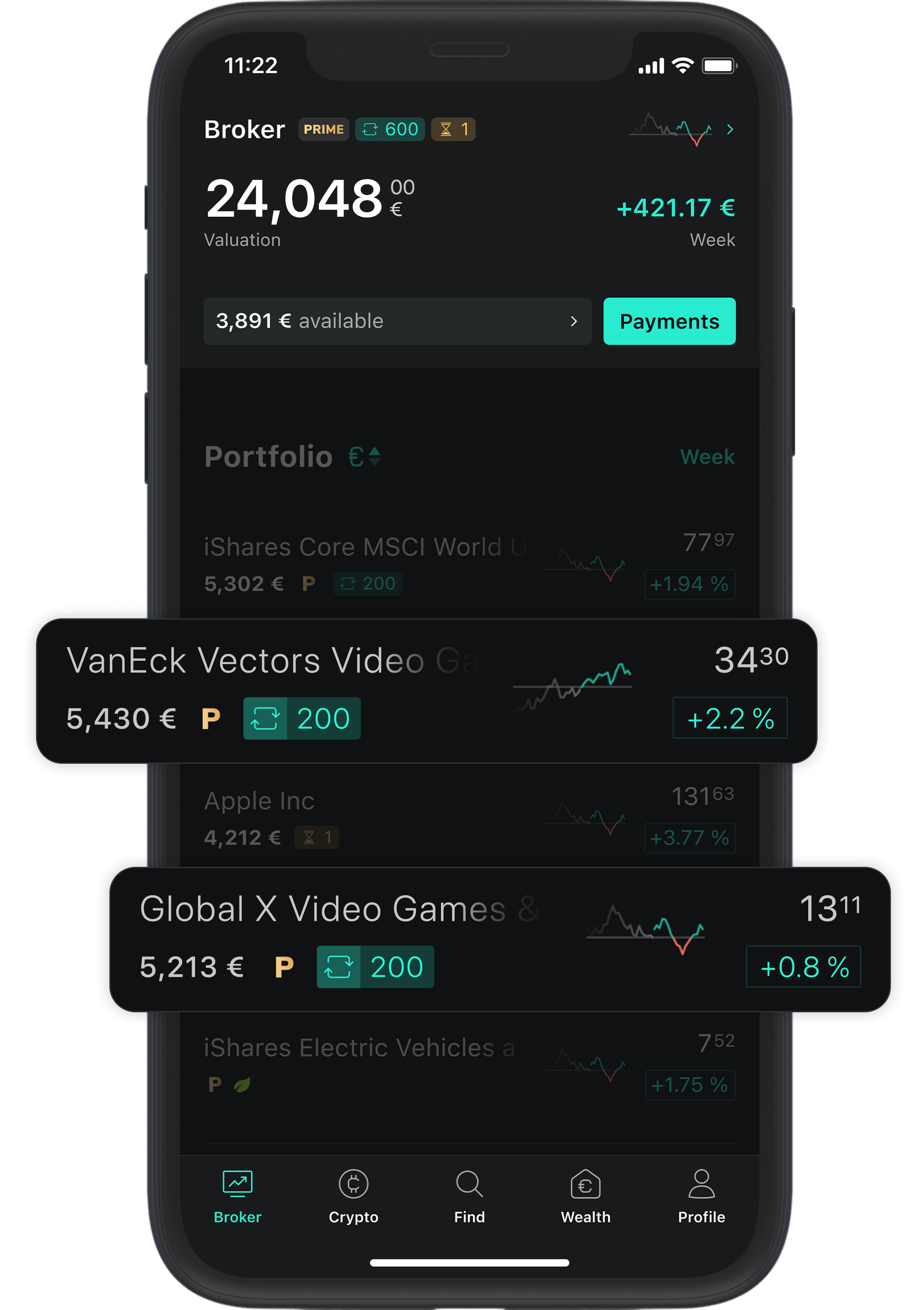

Gaming-ETFs im Scalable Broker

Die Gaming-Branche boomt: Mehr als 40 % der Deutschen spielen Video- oder Computerspiele1, die globalen Umsätze der Branche wachsen rasant2. Mit Gaming-ETFs, wie etwa der VanEck Vectors Video Gaming and eSports ETF, können Anleger kostengünstig und breit gestreut in Videospiel- und E-Sports-Unternehmen investieren. Mit dem Scalable Broker können Sie Gaming-ETFs gebührenfrei handeln und besparen.

1 Quelle: Statista, 2020: https://de.statista.com/themen/1095/gaming/

2 Quelle: Reuters, 2020: https://www.reuters.com/article/esports-business-gaming-revenues-idUSFLM8jkJMl

Under the Xtrackers brand, DWS offers more than 200 ETFs on various asset classes. More than 140 billion US dollars in assets under management are invested in Xtrackers ETFs. In 2007, Xtrackers started as a specialist for synthetically replicating ETFs; today, physical and synthetically replicating ETFs are part of the product range.

Amundi ETF is the leading European ETF provider with over €227 billion in assets under

management. Amundi offers a wide and innovative range of over 300 ETFs at a competitive price, giving investors the power of choice to achieve their goals: from key portfolio building blocks to the widest selection of responsible ETFs in the European market.

iShares is the ETF division of BlackRock, the world's largest asset manager. iShares has $1.85 trillion under management in its ETFs. The offering comprises more than 800 ETFs worldwide, of which more than 300 are available to investors in Germany. iShares ETFs benefit from BlackRock's expertise in portfolio and risk management.